Is Bankruptcy the Answer?

Debt, Owing, Indebtedness. These are all words used to indicate a situation in which someone is obligated to pay something to someone else. Unfortunately, sometimes that obligation gets out of control and exceeds the ability of the debtor to repay. Is Bankruptcy the answer to my concerns and fears?

Financial obligations are a common experience to all – individuals, businesses, and government. Consider this… the U.S. government is projected to have a federal budget deficit of $2.3 Trillion in 2021. Now that’s a serious overrun!

In the United States, consumer debt has risen to an average of more than $90K, including credit cards, loans, mortgages, and more. When you compare that to the average 2020 household income of $87K1, that is a pretty significant debt ratio.

I Owe. I Owe. So Off to Work, I Go.

But, what if I can’t go to work? In the current business market, jobs can be hard to find and/or keep. Illnesses happen. Family emergencies are real. Keeping up with the bills can quickly become overwhelming and seemingly impossible. So how do we keep our heads above water?

I don’t know much about bankruptcy, but I read about businesses filing for it all the time. Is bankruptcy the answer?

Let’s start by defining what it actually is. Bankruptcy is a legal proceeding that helps the debtor get out of debt. Sounds like it could be a solid path to pursue, right? Well… it’s just not that simple. There is a lot to research and decide before starting the process.

- Should I file as an individual or a business entity?

- Which chapter is the best for me?

- Will my debts be discharged? Or, will I still owe money?

- Can I keep my home? Car?

- Is there a difference between filing at the Federal level and at the State level?

- How do I know all of the laws and regulations that apply?

- How do I fill out all the forms AND submit them to the right places on time?

- Will I have to appear in court?

- What happens next?

That’s a big list, and we are just scratching the surface.

So now we are back to the question… Is Bankruptcy the answer to my concerns?

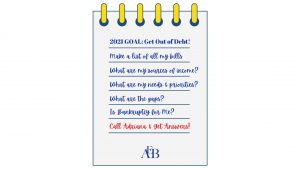

Before making this decision, there are some key steps you can take at home to get a real picture of your situation. Whether you use a notepad, a spreadsheet, or a financial system, take a moment to document your income, debts, gaps, and goals. Write down your questions and concerns. Consult your tax advisor and your attorney to get a full picture of your situation and options.

Do you have questions? Contact the team at the Law Office of Adriana E Baudry. We are here to help.

1 – https://www.fool.com/the-ascent/research/average-us-income/